How to Use Recruiting Funnel Metrics for Talent Forecasting

You’ve heard me talk about some of the trends in recruiting measurement recently, and today we’re going to continue the conversation. However, I’m going to target some specific metrics companies can use to evaluate their recruiting funnel and talent forecasting efforts. While these involve simple math, they offer valuable insight into your recruiting process and how it is operating.

The Typical Recruiting Process

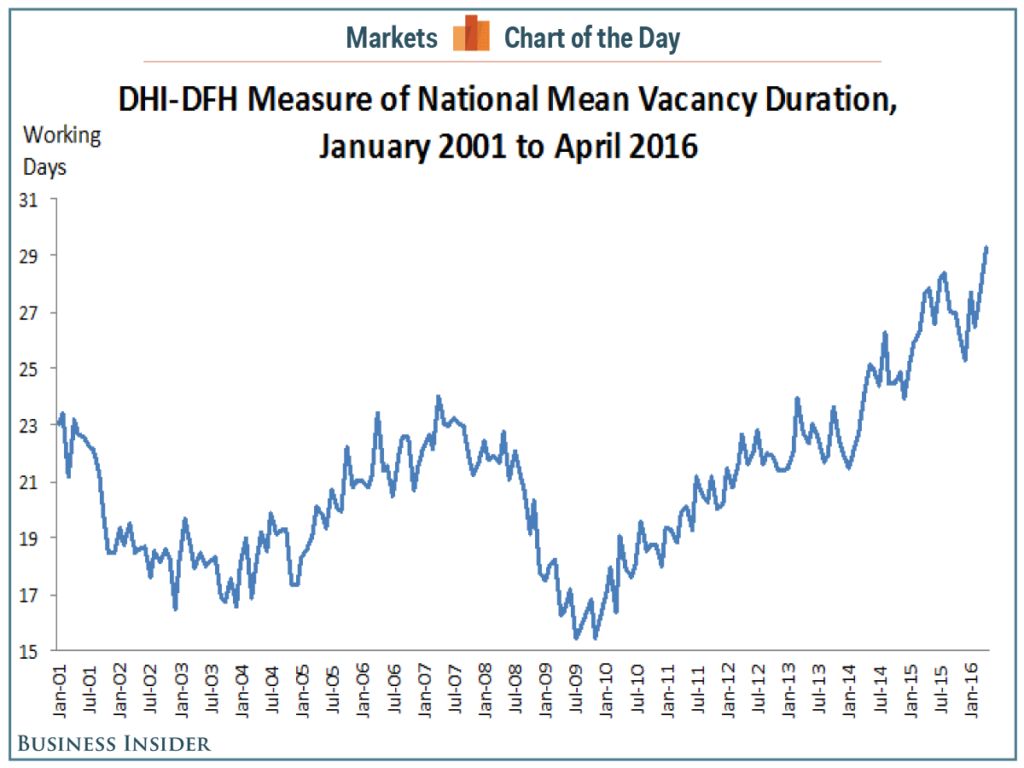

According to our research, time to fill is the most important measurement for companies to measure individual recruiting performance. And you know what? It matters to candidates, too. Recent data points to time to fill increasing to levels nearly double that of six years ago.

At the same time, we all know there is a quality element in there to focus on as well. I believe the length of the process involved is a factor worth digging into. When it comes to your talent acquisition process, what is the “right” length? Consider this common scenario (note-this is not a sourcing conversation, which typically looks very different):

- Week one: Shelly applies with your company via the website. She is a top-tier candidate.

- Week two: Your recruiter does a phone screen and passes the resume to the hiring manager.

Week three: The hiring manager finally reviews the resume and agrees that Shelly should be interviewed. The recruiter schedules the interview for the following week. - Week four: The interview takes place, and the hiring manager wants to bring her back for the second round with a member of the executive team.

- Week five: Shelly interviews with the executive team member, and after the successful completion the hiring manager decides to extend an offer. He contacts HR to assist with the offer process and to obtain the necessary approvals.

- Week six: Prior to receiving the offer, Shelly has to complete a personality assessment that is mandatory for all candidates before they can be offered a position. She scores high in the proper areas.

- Week seven: The offer goes out to Shelly, but she declines. She just accepted another offer from a competitor.

In this scenario, we can make the case that the talent acquisition process was too long and drawn out. A month and a half from the application to the offer for a top-tier candidate is not a winning strategy, because those candidates are probably going to have multiple competing offers, and the sooner you can make a serious offer, the better. It also brings up the conversation of candidate experience—if you must have a process that is longer than the norm, how can you keep the candidate engaged throughout? Candidate satisfaction is another measure companies use to evaluate individual recruiter performance, but more than half of companies either aren’t tracking it at all or are only using anecdotal information to support this.

In this talent analytics case study, Opower started out, like many companies do, with a normal approach to hiring before moving to a more regimented, data-driven approach. The results were astounding, with the data backing up various elements from how many interviewers it takes to make a good hire to being able to forecast hiring needs with high accuracy.

On the other hand, there are times when the process can go entirely too quickly. Yes, as strange as it sounds, hiring too quickly could cause issues with selecting the wrong candidate. Think about the hiring managers you know–how many have used “gut feel” as their deciding factor, only to regret the decision later? In other words, there may be too few points in the process to filter out candidates that don’t fit the culture, job requirements, or other qualifications. It doesn’t have to be six months long, but there should be a clear “funnel” effect as people progress through the phases of your recruiting process, reducing the qualified candidates until only a few are left standing.

Bottom line: there certainly isn’t a one-size-fits-all kind of approach. Some organizations vary quite a bit from the normal standards that most of us have come to expect. For instance, the Lampo Group in Nashville has a 12-step interview process that can take months to complete. Sounds strange to me, but it’s hard to argue with success. The organization has been voted a “best place to work” in Nashville at least seven times, so that goes to show us that there is no “correct” answer for this question other than what meets the needs of your specific organization, culture, and brand.

- Consider the talent acquisition process your organization follows. Would you say it’s too long, too short, or just about right? More importantly, why would you say that? What data do you have to back it up?

- Based on your answer to the previous questions, what changes could you make to your talent acquisition process to make it even more effective, regardless of the length?

Recruiting Funnel Metrics

Now that we’ve examined the hiring process, let’s move to some specific recruiting funnel metrics.

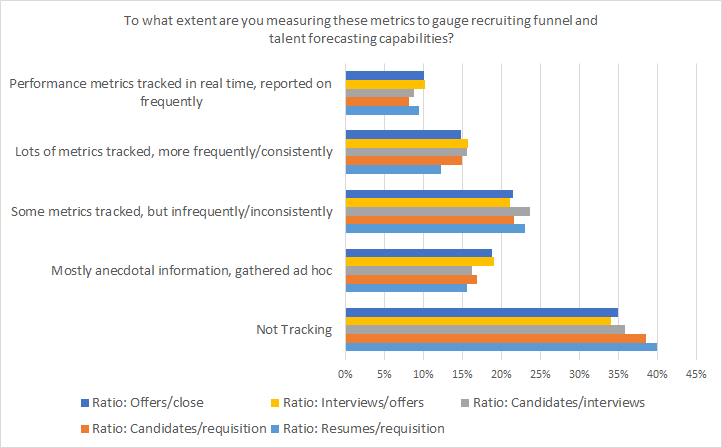

As you can see in the graphic above, many companies, between 34 and 40%, are not tracking any of these metrics. At the same time, they are simple to calculate, easy to benchmark, and offer valuable insights into your hiring funnel. Consider these examples:

- After measuring, you determine that your average offer to close ratio is 2:1, however, for one manager the ratio is 1.3:1. Why? How is that manager getting more “yes” responses to offers? What is that manager doing differently? Are they delivering the offer instead of the recruiter? Is the manager calling the candidate to answer questions and personally extend an invitation to join? Something this manager is doing is getting better results, and it’s important to dig into what it might be so that the practice can be expanded to other hiring managers within the organization.

- Your interview to offer ratio is 12:1, but after looking at interview notes and candidate ratings, you see that about 20% of the candidates had some sort of red flag on their resume that should have prevented them from coming to interview. If you can put a process in place with those doing your initial screening, you can reduce the time and resources dedicated to interviews with poor-fit candidates and improve your ratio.

Those are two simple, yet common, examples of how companies can leverage ratios to benchmark processes and determine where any improvements can be made. Another aspect of using these ratios is the ability to forecast your pipeline activities.

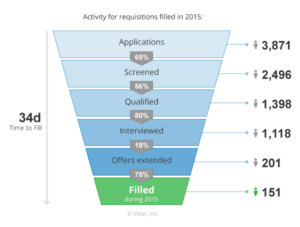

Credit: Visier

If you know that it takes twenty five software developer candidates to find ten interviewees, and ten interviews lead to one offer, then you can back into your hiring needs for multiple positions. If you need to fill ten software development jobs, then you know that you need at least 250 candidates in the pipeline to be able to hit your target. This is rudimentary math, but it beats the feeling of “hopefully this will be the one candidate I need to fill the req” with every person that applies. Knowing you have numbers on your side and that statistically, you will find the right person within that set of twenty five applicants helps to get the focus on filling the top of the funnel and moving people along the process.

Using your funnel data is a powerful way to up your game when it comes to recruiting. In the last few years I’ve seen more organizations start to truly see hiring as a funnel-based activity and not one that is dominated by guesswork. As I said earlier, the ratios are simple to find out, and once you have an organizational benchmark in place, you can start cutting the data by jobs, hiring managers, locations, career levels, etc. to find out gaps and opportunities in your hiring practices.

How are you leveraging measurement to improve your hiring processes?

Ben Eubanks is the Chief Research Officer at Lighthouse Research & Advisory. He is an author, speaker, and researcher with a passion for telling stories and making complex topics easy to understand.

His latest book Talent Scarcity answers the question every business leader has asked in recent years: “Where are all the people, and how do we get them back to work?” It shares practical and strategic recruiting and retention ideas and case studies for every employer.

His first book, Artificial Intelligence for HR, is the world’s most-cited resource on AI applications for hiring, development, and employee experience.

Ben has more than 10 years of experience both as an HR/recruiting executive as well as a researcher on workplace topics. His work is practical, relevant, and valued by practitioners from F100 firms to SMB organizations across the globe.

He has spoken to tens of thousands of HR professionals across the globe and enjoys sharing about technology, talent practices, and more. His speaking credits include the SHRM Annual Conference, Seminarium International, PeopleMatters Dubai and India, and over 100 other notable events.